Stacy Zigman is a New York | Long Island

REALTOR® with Special Training in Selling

Short Sale Properties!

Are financial difficulties from work troubles, medical issues, or matrimonial matters making it hard for you to meet your monthly mortgage payments? Have you maxed out your credit cards in order to stay afloat and continue living in your New York home? Have you tried a mortgage loan modification that hasn't worked, or are you facing foreclosure? If you are experiencing any of these hardships, you are not alone.

Many Long Islanders who own real estate want or need to sell a home today due to unforeseen circumstances. This may be especially true for those who bought or refinanced a property during the housing bubble, or those impacted by the COVID-19 pandemic. But what do distressed Nassau County, Suffolk County and Queens County homeowners do when a home they need to sell is worth less than what is owed on a mortgage? The answer: a short sale.

What is a Short Sale?

A short sale is a process that allows a homeowner to sell a property and pay off an existing mortgage or mortgages at less than what is owed. Why would a lender agree to accept a reduced payoff on a mortgage? It's simple: because the bank receives more money through the short sale process than it would receive through a lengthy and tedious foreclosure process.

A short sale contains complexities not present in a typical real estate transaction. An experienced and qualified short sale Realtor is an invaluable resource to help you accomplish a short sale. Stacy Zigman is one such Realtor.

Seller Advocate | Realtor Short Sale Specialist - Stacy has been a licensed New York Realtor since 1994, and has specialized training in handling short sale transactions. Stacy holds a Short Sale and Foreclosure Resource ("SFR") designation, as well as a Realtor Short Sale Professional ("RSSP") certification. Ms. Zigman has many years of practical experience meeting the extensive requirements of lenders and successfully negotiating a discounted payoff. Stacy has been featured in Newsday as an authority on New York short sales. Her knowledge and experience affords you a much better chance of completing a short sale, and doing so on an expedited basis.

Stacy observes, “Many of my short sale clients contact me when they have exhausted all other options and see no relief in the near future. The loan modifications or other home retention programs they have tried have not worked or only helped temporarily. They now want permanent mortgage relief, so they can get back on their feet and move on with their lives.”

Homeowner Benefits of a Short Sale

There are many reasons why a financially-strapped Nassau, Suffolk or Queens borrower should consider a short sale over a foreclosure.

Costs You Nothing - When you participate in a short sale, you incur no out-of-pocket costs. Expenses paid by a seller in a typical real estate transaction, such as Realtor commissions, attorney fees, New York transfer taxes, title company charges, and back taxes owed on the property, are absorbed by the lender. This may be true even if the lender agrees to pay you a cash incentive.

Forgiveness of Loan Deficiency - If a bank forecloses on your home and the proceeds of the judicial sale are not sufficient to repay the loan balance, a deficiency will result. In certain states including New York, the lender may have the right to sue you for the deficiency, plus interest and legal costs. If the lender obtains a deficiency judgment, it may take further steps to collect the deficiency from you by seizing your bank accounts, garnishing your wages, and placing liens on your other property. With a short sale, however, the lender may allow you to walk away from an underwater home without obligating you to repay the deficiency on your loan.

Control of Your Life - Foreclosure is a time-consuming legal process accompanied by a lengthy period of uncertainty. Losing a home in such an extended manner can strain marriages and cause anxiety, stress and depression for you, your spouse and your children. A short sale lets you take charge of your life. As Stacy explains, "When you choose to do a short sale, you are making the decision to be responsible and regain control of your life. You can arrange your moving plans in advance, like a traditional home seller would, and leave your home gracefully on your own terms."

Better for Your Community - In addition to aiding you and your family, a short sale may be healthier for your local community. Homes abandoned due to foreclosure typically deteriorate due to a lack of maintenance and landscaping, and become attractions for stray animals. Abandoned homes may have broken windows, unsecured pools, unstable decks or other dangerous structural defects, all of which could pose hazards to curious teens or children. Abandoned homes are also more prone to criminal activity, with copper wires, air conditioning units, appliances and water heaters acting as lures.

You may be friends with your neighbors, and not want to subject them to the negative impacts of foreclosure. You may also want to stay in the neighborhood (or already live nearby if the underwater home is an investment property) and not carry around the stigma of foreclosure. If these things matter to you, a short sale may be the appropriate option. Stacy adds, "Some of my clients really cared about their communities, and didn't want to see their properties deteriorate. They felt good regaining their financial footing without undermining the integrity of their Long Island and Queens neighborhoods."

Cash Incentives - Many banks today encourage distressed homeowners to choose short sales over foreclosures by offering cash incentives. Lenders recognize that short sales are generally better for the bottom line than foreclosures. Short sales return properties to lenders faster than foreclosures, minimizing the tax, maintenance, legal and other carrying costs that accrue to lenders. Homeowner incentives also tend to ensure that properties return to lenders in better condition, which is reflected in the higher average selling prices that short sales typically garner compared to foreclosure sales.

Stacy points out, "Depending on borrower qualifications, participating lenders may offer cash incentives. The incentives provide relocation assistance to financially-strapped New York homeowners, and allow for an easier transition away from ownership of a home they can no longer afford."

Do I Qualify for a Short Sale?

In order to be eligible for a short sale, you must demonstrate financial hardship (circumstances that prevent you from paying off the loan). Acceptable hardships vary depending upon the lender's particular guidelines. Short sale programs are now more commonplace, and lenders have expanded the range of circumstances under which borrowers may establish financial hardship.

Commonly Accepted Short Sale Hardships Include -

- Unemployment (job loss/business failure)

- Reduced income (salary decrease/wage garnishment)

- Job relocation

- Increased expenses (mortgage rate adjustment)

- Medical situation (severe illness/medical bills)

- Death (spouse/family member)

- Divorce or separation

- Bankruptcy

- Property damage

- Military service

- Incarceration

Hardship Letter | Affidavit - As part of the short sale application process, the lender or servicer may ask the borrower to complete a hardship letter or affidavit, as well as a financial statement, in order to get a clear picture of the underlying events. Stacy emphasizes, “Many of my short sale clients don’t have one particular hardship, but rather have experienced a series of events over months or even years. For example, a job loss combined with ongoing medical issues, or increased expenses compounded by a divorce.” Whatever your personal situation, Stacy can help you gather the important documents and effectively communicate your circumstances to increase the probability your short sale application will be approved.

Can I Still Qualify with Assets or No Late Payments?

Yes. In an effort to encourage short sales and discourage foreclosures, many lenders have adopted a more flexible posture when determining borrower eligibility. Depending on the program, a short sale applicant may qualify even if current on the mortgage if it can be shown that default is imminent. Ms. Zigman explains, “Some of my clients do not have late mortgage payments but are delinquent on other bills. They cancel their medical insurance, stop taking medication or skip doctor visits to save money. Others max out credit cards to pay for necessities or borrow money from family and friends.”

It is important to speak with your lender about its requirements and whether or not it requires borrowers to be delinquent on their mortgage payments. The ability of a homeowner to stay current on mortgage payments while participating in a short sale may potentially help to preserve credit, allow for a faster rehabilitation of credit, and expedite future eligibility for loan programs.

Multiple Lenders

If you took out a second mortgage to help buy your home, or secured a home equity loan or line of credit after your home purchase, you can still do a short sale. However, the process is more complicated since both mortgage holders will conduct independent short sale reviews, and each must agree to accept a reduced payoff. A short sale Realtor with experience closing multiple lien short sales now becomes vital.

As Stacy explains, “When two or more mortgage holders are involved, each will require separate and possibly differing documentation depending on the relevant guidelines, loan type and borrower financial situation. Similar to a short sale with one lender, I assist my clients in gathering the necessary documentation, but this time I prepare two short sale packages and submit one to each mortgage holder for its respective review and approval.”

To secure a release of liens and allow title to transfer, both mortgage holders must agree to a reduced payoff. How does this work? Typically, the first bank will offer the second a lesser payment of the short sale proceeds. The second will either accept the payment or, Zigman points out, “there may be some back-and-forth negotiations.” Ultimately, it is generally in the second’s best interest to accept what is offered since, if the house is foreclosed upon, the second in line may walk away with nothing.

What if I Have Personal Judgments?

Many homeowners facing mortgage payment challenges also struggle with other mounting debt. If you have personal judgments that are liens on your property, you may be able to satisfy these liabilities as part of the short sale transaction. Stacy notes, “Some of my short sale clients had judgments for amounts owed unrelated to the mortgage. Their creditors were informed of the pending short sale transaction, and agreed to accept reduced payoffs at closing in full satisfaction of the judgment amounts. I disclose the reduced judgment payoffs as part of the short sale application process, and when the short sale is approved and the transaction closes, the homeowner is relieved of these other debts as well.”

What if I Have Tax Liens?

If a Nassau, Suffolk or Queens County homeowner has unpaid federal or New York State income taxes, there may be tax liens (warrants) on the property. With a proper showing, the Internal Revenue Service and the New York State Department of Taxation and Finance may issue (prior to closing) conditional commitments to release the property from the tax liens, and certificates discharging the property from the liens once the transaction closes. The IRS and NYS lien releases allow a homeowner to complete a short sale transaction, but do not eliminate responsibility for the unpaid taxes.

It is important that Stacy’s short sale clients share information with her upfront about unpaid taxes or personal judgments. Based on her experience, Ms. Zigman is mindful that “time may be needed to communicate with and provide documentation to the governmental agency, creditor or debt collector, and getting to the right person isn’t always easy.”

The Bank Has Contacted Me

Some lenders are now contacting borrowers to solicit participation in their short sale programs. However, you typically are free to select your own Realtor even if you enroll in your lender's short sale program. Short sale program solicitations are generally time sensitive, and immediate action may be required to avoid foreclosure on your property. If your lender has contacted you about participating in its short sale program, you should strongly consider contacting Ms. Zigman.

Stacy has familiarity with the short sale procedures and requirements of the various lenders such as Bank of America, JPMorgan Chase, Wells Fargo, CitiMortgage, Ally Financial, BNY Mellon, PNC Financial, and government entities Fannie Mae, Freddie Mac and Federal Housing Administration ("FHA"). Ms. Zigman can help evaluate whether you are a likely candidate for your lender's short sale program. Stacy can also facilitate and expedite the process for a successful short sale by:

- professionally and appropriately marketing your home in the context of a short sale;

- maintaining continuous and constructive communication with you, your lender, and all parties involved in the transaction;

- assisting with the development and submission of documentation required by your lender to establish short sale eligibility; and

- otherwise performing the ongoing follow up tasks that inevitably arise during the course of a short sale.

Choosing the Right REALTOR®

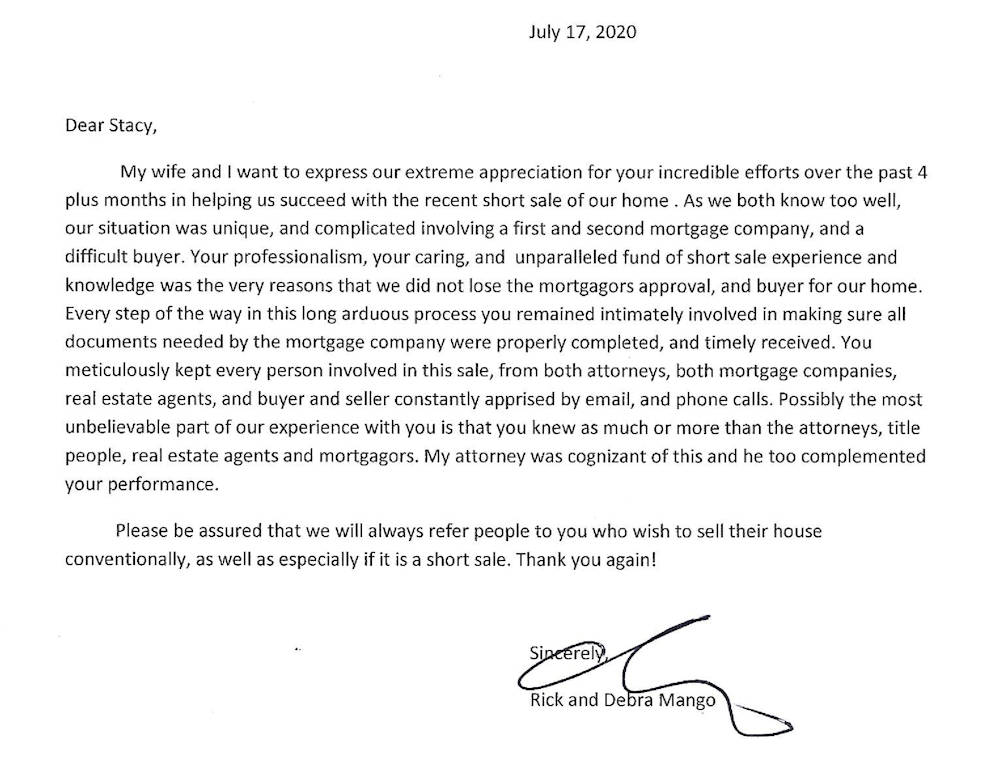

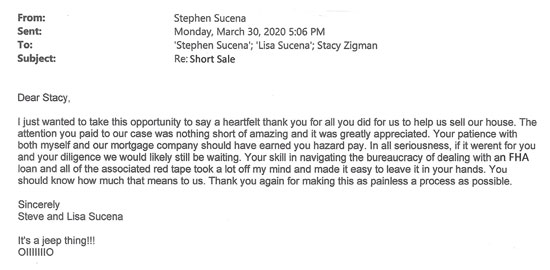

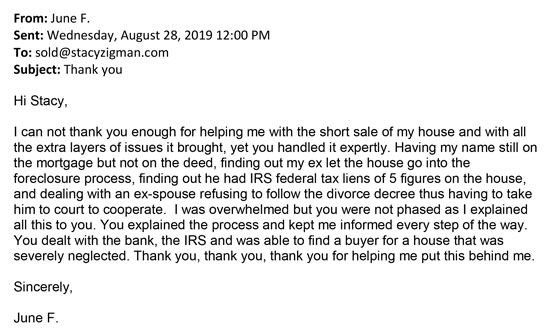

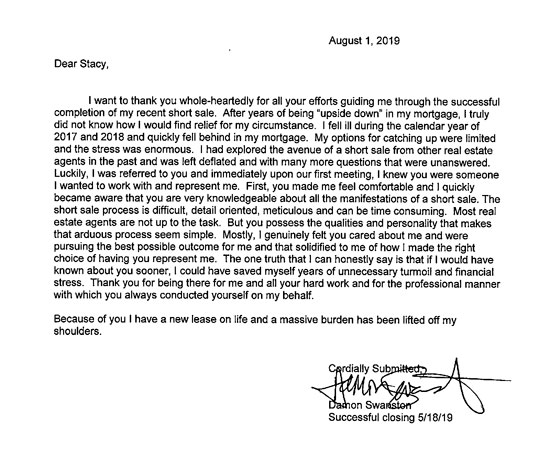

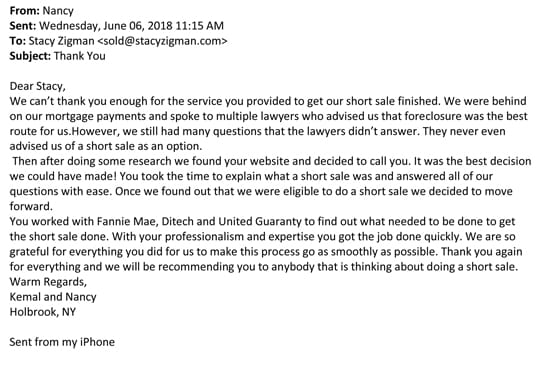

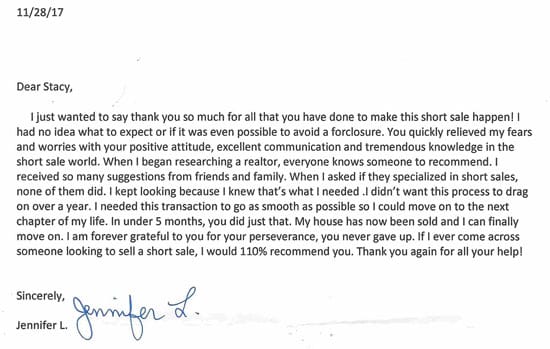

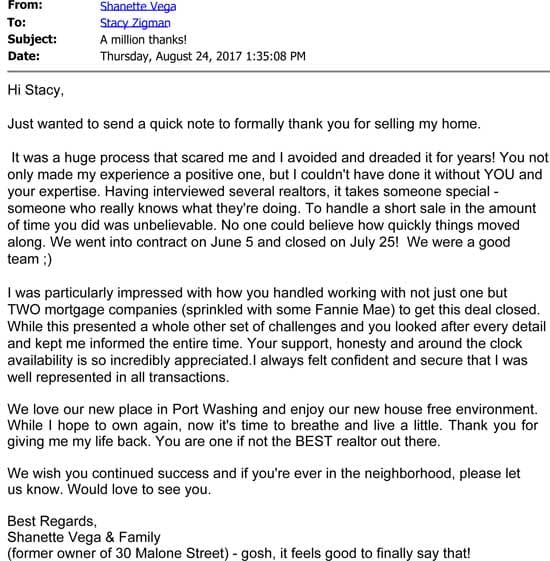

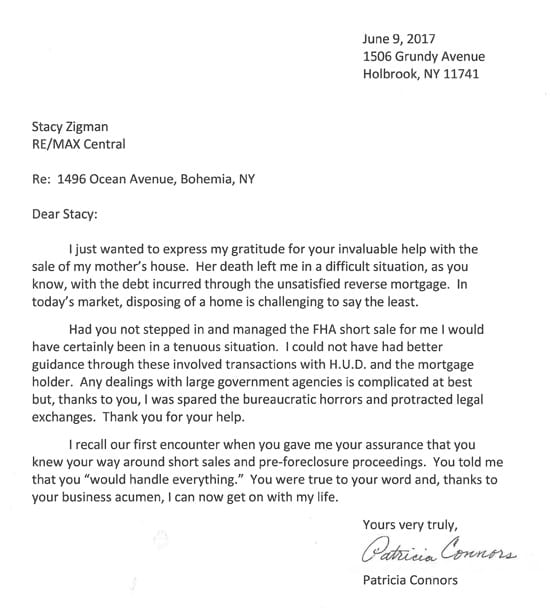

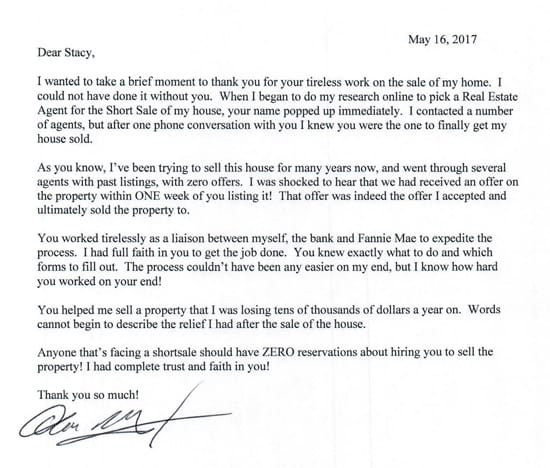

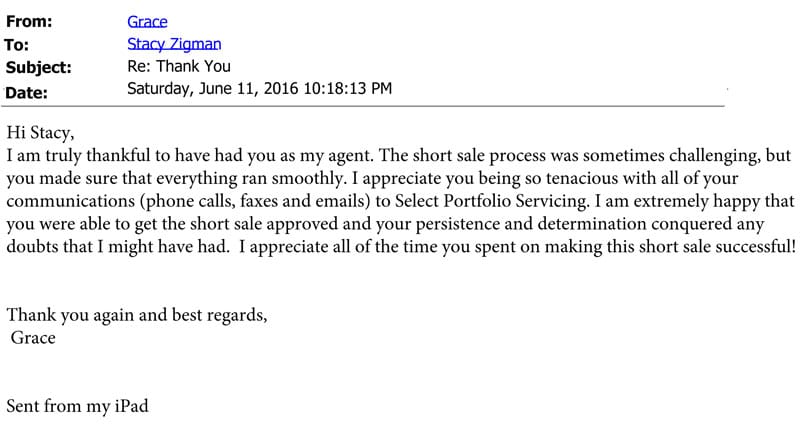

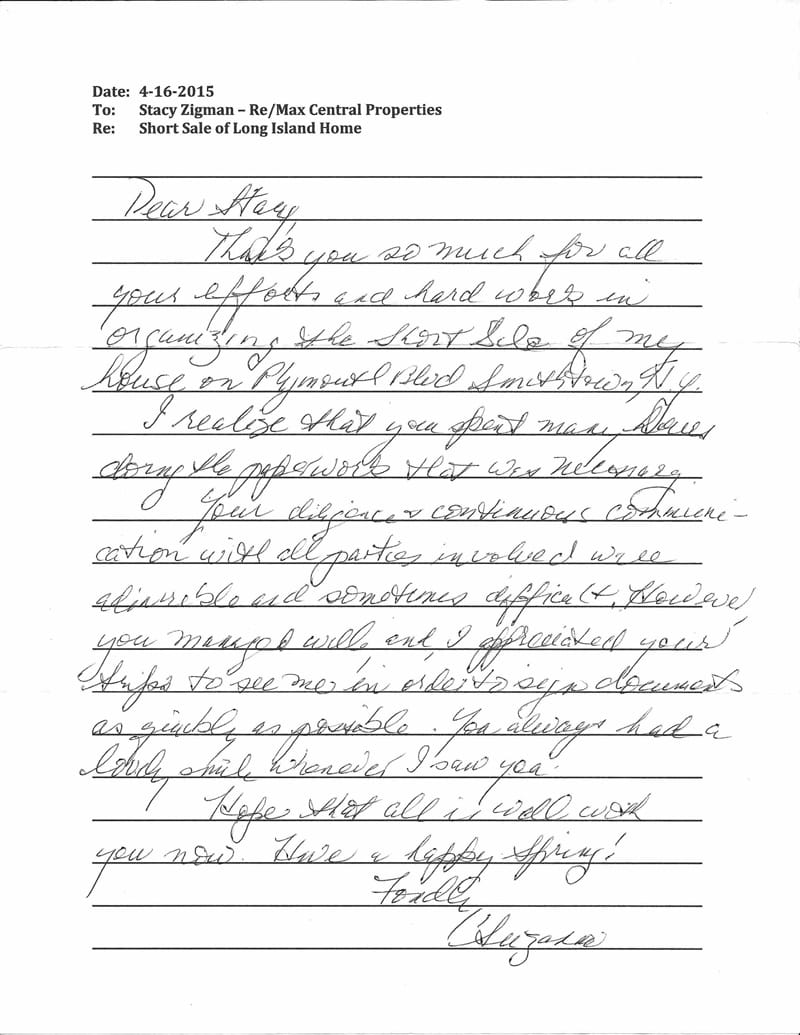

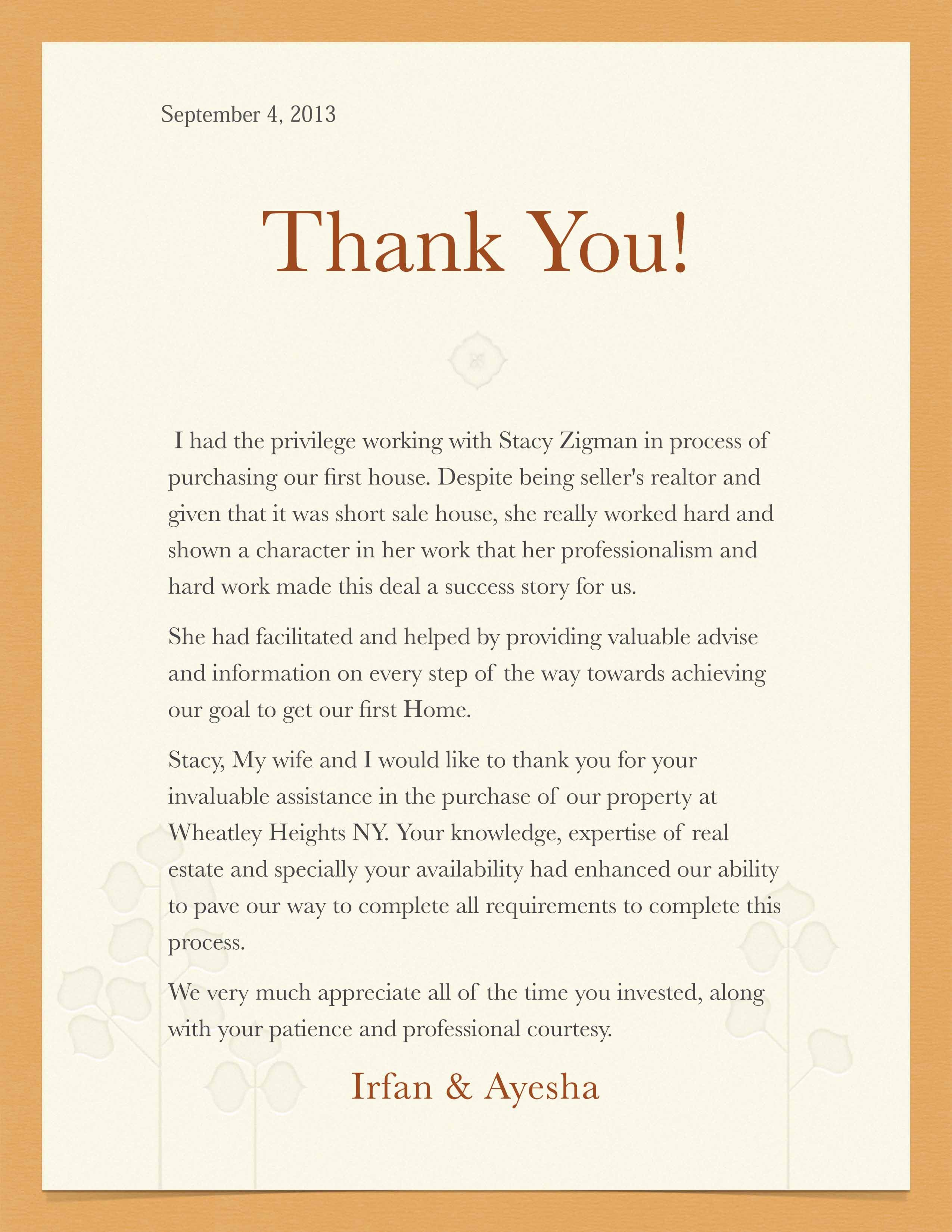

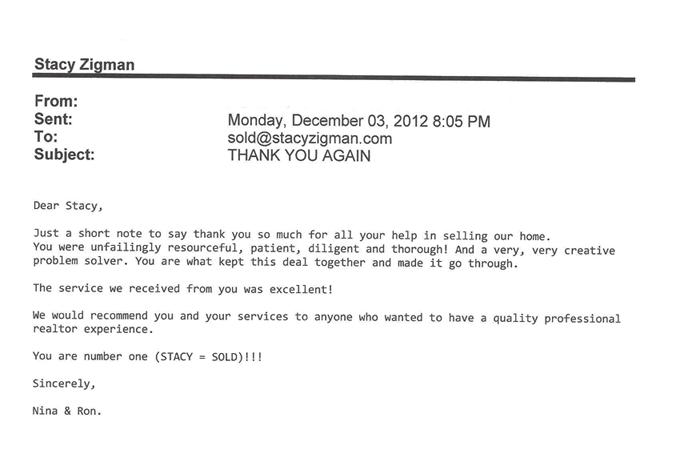

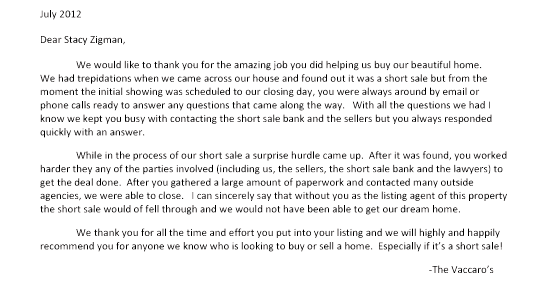

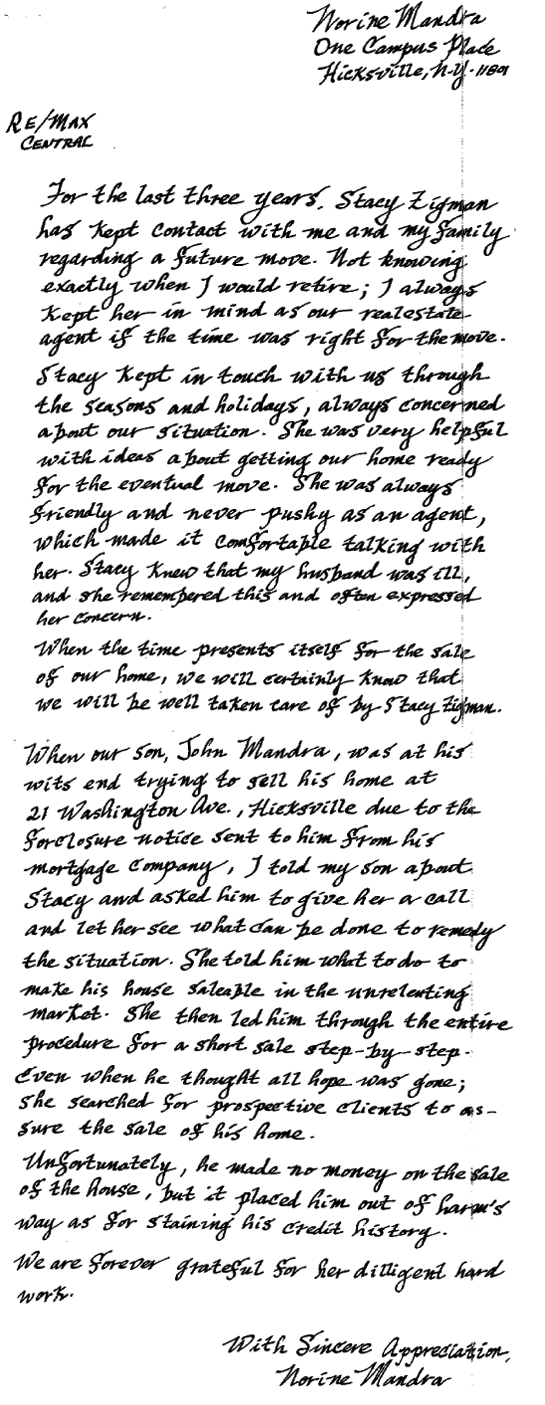

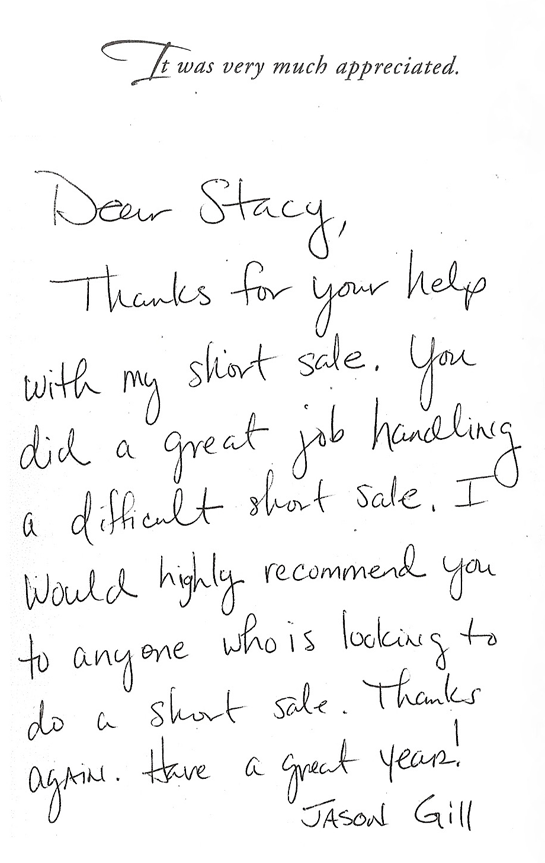

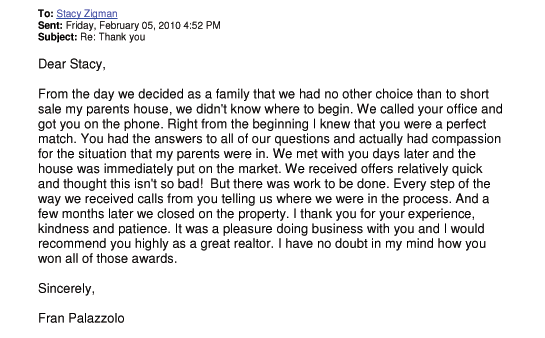

In addition to the knowledge and expertise Ms. Zigman has acquired through her short sale designations and experience, Stacy's compassionate and empathetic nature make her the perfect agent to work with distressed Long Island homeowners. Stacy notes, "Short sale clients are clients for life. When you help a family with financial difficulties, they never forget you." Stacy has received many thank you letters from satisfied short sale clients. A few of those testimonial letters are shown below.

If you know someone who would benefit from talking to Stacy, feel free to call or pass along her contact information. Her office number is 516-827-SOLD (7653) and her email address is sold@stacyzigman.com.

Notes of Thanks:

Disclaimer: The content in this website is provided for general informational purposes only. It is not intended as, and does not constitute, tax, accounting, legal or other professional advice. Consequently, this website should not be relied upon or used as a substitute for consultation with tax, accounting, legal or other professional advisors.